I get asked this all the time.

It’s a fair question.

And I have a straightforward answer:

No.

But if you really look under the hood of this market, there’s actually a better question:

Was there already a bubble… and did it already pop?

Both questions can be answered with the same facts.

What bubbles actually look like

Real bubbles don’t happen quietly.

They form during euphoria — when everything goes up, bad news doesn’t matter, and investors stop caring about price.

Think back to:

- 1999 dot-com stocks doubling on no revenue

- 2006 housing speculation

- 2021 meme stocks and SPACs

That’s what excess looks like.

Now compare that to today.

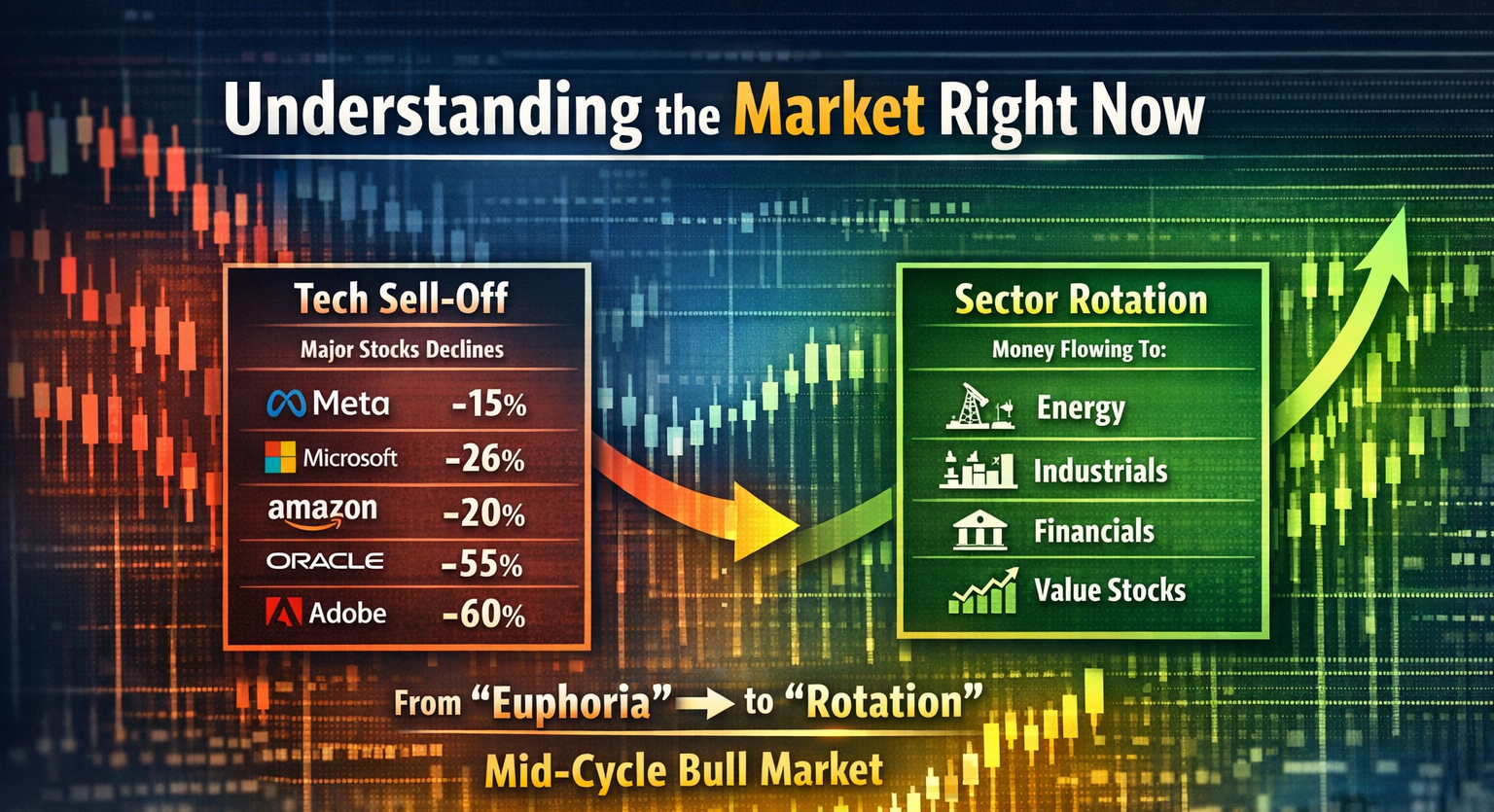

Some of the biggest, highest-quality companies in the world have already gone through massive corrections:

- Meta Platforms down ~15% even after record earnings

- Microsoft down ~26%

- Netflix down ~42%

- Amazon down ~20%

- Oracle Corporation down ~55%

- Salesforce and Adobe closer to 50–60% at one point

These aren’t speculative startups.

These are cash-flow machines with fortress balance sheets.

It’s very hard to argue we’re in “euphoria” when market leaders have already been repriced down 20–60%.

Add to that:

- Tech short interest recently hit the highest levels in years

- Sentiment surveys have stayed cautious

- Cash balances remain elevated

- Investors are still looking for reasons to be defensive

That’s not bubble behavior.

That’s skepticism.

So how is the market near all-time highs?

Here’s the word of the day:

Rotation.

The S&P 500 can hit new highs even while many big stocks are down because money simply moves.

Capital doesn’t disappear — it shifts.

Over the past year we’ve seen money flow:

- out of tech leaders

- into energy

- into industrials

- into financials

- into value and cyclicals

That’s exactly what happens mid-cycle in a healthy bull market.

Leadership changes.

Different sectors take turns.

The market broadens.

Historically, this type of rotation tends to occur in the middle innings, not at the end.

Late-cycle markets narrow and get speculative.

Mid-cycle markets rebalance.

We’re seeing the latter.

The real problem I see

This is where most investors get tripped up.

“Diversification” has somehow become:

Own everything.

Own every fund.

Own every style.

Own so much that nothing matters.

When you own 10–20 overlapping funds, you don’t have diversification.

You have dilution.

You end up:

- matching the index in good years

- underperforming after fees

- and never really benefiting from the winners

Proper diversification means owning the right mix, not owning the entire grocery store.

If you haven’t done particularly well the last couple of years while the market has been strong, odds are you’re simply over-diversified and stuck hugging benchmarks.

My bigger picture view

Zoom out.

We’re not in a bubble.

We’re in the middle of a technological shift that looks a lot more like the mid-90s than the late-90s.

AI, automation, and semiconductor infrastructure are changing how every industry operates.

This isn’t hype — it’s productivity.

And historically, productivity cycles lead to:

- higher earnings growth

- expanding margins

- and stronger long-term returns

The internet did it.

Cloud computing did it.

AI is next.

The companies enabling this shift aren’t lottery tickets.

They’re some of the most profitable businesses ever created.

That’s not bubble territory.

That’s structural growth.

Bottom line

No, I don’t think we’re in a bubble.

I think we’re in the middle of a bull market that’s rotating leadership and repricing risk — which is exactly what healthy markets do.

The better question is:

Are you positioned correctly for what’s actually happening?

If you’re not confident, send over your most recent statement.

We’ll give you a straight, honest take — no pressure, no fluff.

Sometimes a small adjustment makes a big difference.

— Jacob