As an investment advisor based here in South Florida, one of the most important things I can do during a market panic is offer clarity, context, and peace of mind.

And after one of the worst two-day drops in S&P 500 history—with the Dow set to open down another 1,000 points this morning (Monday, April 7, 2025)—I believe it’s time to step back, zoom out, and look at what history tells us.

Yes, the Drop Was Bad—Historically Bad

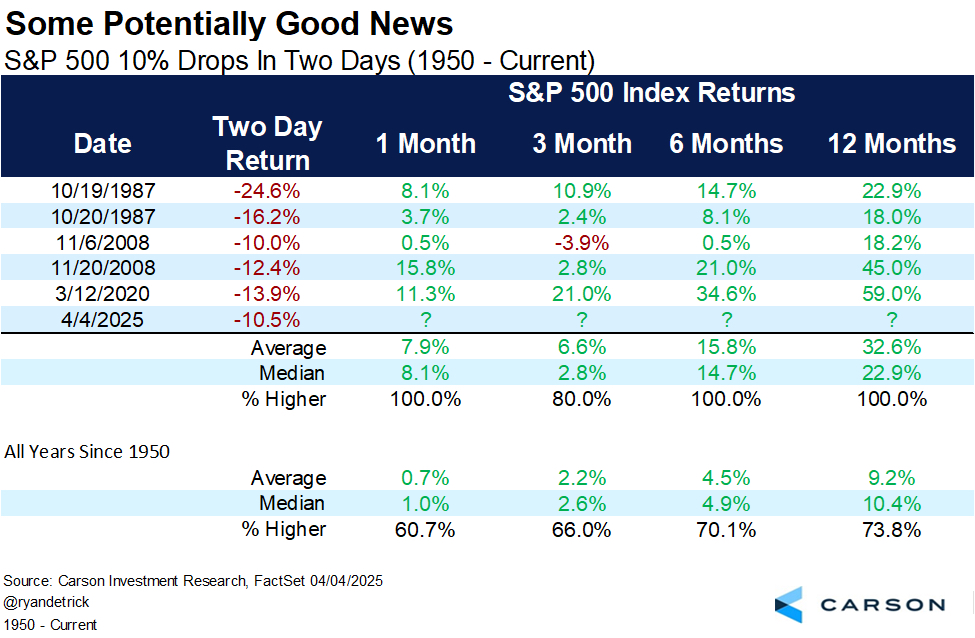

Between Thursday and Friday, the S&P 500 dropped over 10% in just two days. That’s a level of volatility we’ve only seen a handful of times in the past 75 years—events like Black Monday in 1987, the depths of the 2008 financial crisis, and March 2020 during the COVID crash.

But here’s what might surprise you…

In all of those cases, the market rebounded significantly in the months that followed.

📊 Take a look at the chart below from Carson Investment Research, showing past 10% drops over two days and the forward returns over 1, 3, 6, and 12 months:

- Average 1-Year Return After a 2-Day Crash: +32.6%

- % of Times the Market Was Higher 12 Months Later: 100%

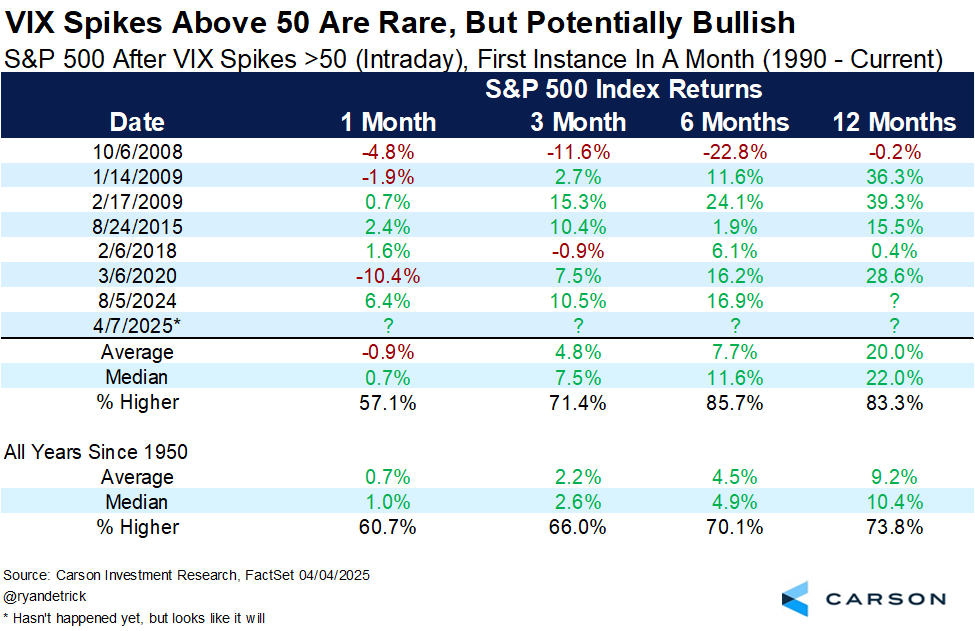

The VIX Just Spiked Above 50—And That’s Rarely a Bad Thing

Another major development this week is the VIX (Volatility Index) spiking above 50. That level is extreme—it’s only happened a few times since 1990—and it typically signals capitulation and fear exhaustion, not the start of a prolonged bear market.

According to the data:

- When the VIX spikes above 50, the S&P 500 is higher 83% of the time one year later

- The average 12-month return following such spikes is nearly +20%

While short-term volatility may continue, this is often where long-term investors are rewarded for staying the course—or even stepping in.

What Does This Mean for South Florida Investors?

If you’re living in Palm Beach, Fort Lauderdale, Miami, or anywhere in South Florida, and you’re feeling uncertain about your portfolio or financial plan right now, you’re not alone.

We’re here to help you navigate moments like these with insight and strategy—not emotion.

At RollingWave Capital, we specialize in:

- Personalized portfolios that adapt to changing markets

- A unique approach that blends macro context with disciplined risk management

- Transparent, fiduciary advice tailored to your goals—not a cookie-cutter model

What to Do Now?

This may not be the bottom, but based on everything we’re tracking—credit spreads, volatility, and history—there’s a real case to be made that we’re closer to the end than the beginning of this pullback.

If you’d like a second opinion on your current investment strategy, or want to make sure you’re positioned to take advantage of the recovery when it comes…

👉 Book an Intro Call with Me Here »

Now more than ever, the right guidance can make all the difference.

Jacob Craton

Founder, RollingWave Capital

Serving Palm Beach Gardens, Miami, and investors across South Florida